When you consider your financial upcoming, do you feel self-confident or confused? Suitable economical scheduling begins with a realistic assessment of one's present-day monetary situation. You'll need to compute your Web worth to possess a apparent place to begin. From there, placing Sensible targets can manual your short and extended-time period money tactics. But how accurately can these goals change your fiscal overall health, and what methods in case you just take subsequent to ensure you are not just surviving, but basically flourishing economically? Let us check out how a detailed, actionable prepare could change the program of one's financial life.

Understanding your monetary standing would be the cornerstone of helpful money scheduling. Being aware of in which you stand financially requires a clear understanding of your monetary well being and Web truly worth. What this means is you'll need to compile and analyze in-depth data about your assets and liabilities.

Your Web well worth is essentially the difference between what you personal (your property) and That which you owe (your liabilities). Belongings incorporate dollars, investments, residence, and anything of benefit you have. Liabilities, on the other hand, encompass your debts, for instance loans, mortgages, and bank card balances.

To correctly evaluate your monetary well being, you should compute your net well worth by subtracting your complete liabilities from a full belongings. A good net value suggests you have a lot more property than liabilities, suggesting a much healthier money position. Conversely, a damaging Internet truly worth exhibits that your liabilities outweigh your assets, signaling a necessity for instant consideration and adjustment as part of your financial strategy.

It can be critical to regularly update this calculation to trace your fiscal progress over time. Even more, comprehending your economical overall health isn't really pretty much understanding your present-day placement but analyzing the traits in your financial journey.

You should look at changes in your asset values and liability balances, evaluate how they're affecting your net really worth, and establish any opportunity risks or opportunities for advancement.

Once you've assessed your fiscal standing, it is important to set sensible fiscal goals to information your long term endeavors. To start, let's differentiate between your brief-phrase targets along with your long-term visions.

Small-term aims typically span a duration of up to a few decades and might include conserving to get a down payment on an auto, building an crisis fund, or having to pay off superior-curiosity debts. These aims tend to be tactical and remarkably concentrated, requiring frequent evaluation and adjustment. Conversely, your very long-time period visions extend beyond three yrs and will encompass conserving for retirement, funding a child's instruction, or obtaining a home. These require a strategic method, demanding patience and persistent exertion.

When setting these plans, You will need to take into consideration numerous variables for example possible money expansion, inflation charges, and changes with your economical situation.

To established these targets effectively, you should make them unique, measurable, achievable, appropriate, and time-sure (Clever). As an illustration, as an alternative to vaguely aiming to "help you save more cash," specify "I am going to help you save $three hundred month to month towards a $ten,800 emergency fund in the following three yrs." This clarity improves your emphasis and the chance of reaching your objective.

Also, integrate your ambitions with your personal values and Way of living preferences to guarantee they remain motivating and aligned with the broader existence options.

Regularly revisiting and altering these plans is significant as your monetary scenario and priorities evolve.

With all your economic objectives Evidently described, It is vital to create a finances that paves how for achievement. This means not just tracking your cash flow and bills but will also creating strategic selections that align with your extensive-time period targets. A properly-crafted funds acts to be a roadmap, guiding you toward financial stability and growth.

Initially, assess your earnings sources and categorize your expenses. You'll have being meticulous in recording the place each greenback is allocated. This process is vital in figuring out areas in which you can Reduce back, thus expanding your price savings fee. Keep in mind, even modest adjustments in your expending routines can enormously affect your economical future.

Upcoming, prioritize the establishment of the unexpected emergency fund. This fund is a significant buffer towards unexpected money shocks, for example clinical emergencies or surprising task decline. Preferably, it is best to intention to save a minimum of three to six months' worthy of of dwelling charges. This proactive move not just secures your financial foundation but also provides you with satisfaction, letting you to definitely give attention to other economical goals with no frequent get worried of opportunity emergencies. Also, your Way of living alternatives Enjoy a substantial part in successful budgeting. Go with sustainable and monetarily reasonable behavior. By way of example, dining out a lot less frequently, selecting additional affordable enjoyment options, and using public transportation can all be parts of a budget-welcoming Way of living. Every single alternative should guidance your overarching fiscal goals.

Running your credit card debt proficiently is important for protecting financial steadiness and obtaining your lengthy-expression targets. In the area of debt administration, It truly is very important to comprehend and use procedures like personal debt consolidation and credit counseling. These applications can significantly streamline your fiscal obligations and direct you to a safer economical long term.

Personal debt consolidation entails combining a number of debts into a single mortgage having a lower desire fee. This tactic simplifies your payments and may lessen the total you pay common sense retirement planning back in curiosity, making it simpler to deal with your finances. You will discover that by consolidating, it is possible to give attention to a single repayment system, frequently with extra favorable terms, which often can expedite your journey out of credit card debt.

Credit history counseling, Alternatively, provides Skilled assistance on controlling your debts. Participating by using a credit rating counselor will let you have an understanding of the nuances of your financial situation. They can present personalized assistance on budgeting, controlling your spending, and negotiating with creditors to possibly decrease desire premiums or create possible repayment strategies.

It really is an educational source that also retains you accountable, that may be invaluable in sustaining economical self-control.

It's also a good idea to consistently assessment your personal debt administration program. Financial conditions alter, and getting proactive about altering your strategy could help you save from opportunity economic pressure. Don't forget, the purpose will be to not only handle your credit card debt but to do so in a method that supports your overall fiscal wellness.

You might see that shifting from taking care of debt to specializing in expenditure selections opens up a new spectrum of economic opportunities. While you navigate this terrain, understanding the various landscape of financial investment options is vital to maximizing your economical expansion.

First of all, the inventory industry offers dynamic probable click here for money appreciation. By obtaining shares of community firms, you might be fundamentally buying a stake inside their upcoming earnings and growth. Even so, the stock marketplace could be unstable, necessitating a balanced solution and complete investigate.

Housing investment decision stands to be a tangible asset that typically appreciates over time. Whether or not you happen to be obtaining properties to lease out or to sell in a financial gain, real estate can offer both steady profits and extended-expression capital gains. It needs sizeable funds upfront but can be quite a reputable hedge against inflation.

Mutual cash and index funds offer you a method to diversify your investments across a lot of assets. Mutual cash are managed by experts who allocate your cash across several securities, aiming to strike a harmony between risk and return.

Index money, on the other hand, passively observe a certain index such as S&P five hundred, offering a lessen-cost entry into the industry with historically secure returns.

Bonds give a more conservative investment decision avenue, supplying regular money by means of desire payments. They are typically safer than stocks but offer reduced return likely.

Rising financial commitment courses for example copyright and peer-to-peer lending present contemporary possibilities. copyright, while hugely volatile, has demonstrated considerable growth opportunity.

Peer-to-peer lending enables you to lend funds straight to men and women or companies, earning fascination because they repay their loans.

Finally, commodities like gold or oil give selections to diversify and hedge versus market volatility and economic shifts, even though they have their particular set of hazards and complexities.

Checking out expense possibilities provides a strong Basis for constructing your retirement financial savings. As you examine the varied avenues for accumulating wealth, It is really essential to align your alternatives using your expected retirement age and wished-for Life style.

You'll find that a effectively-structured portfolio don't just grows your belongings but will also mitigates hazards as your retirement age approaches.

You need to understand the significance of diversification. Spreading your investments throughout diverse asset lessons—shares, bonds, real estate property, and possibly precious metals—can help deal with risk and smoothens out returns as time passes.

It's also essential to reassess your possibility tolerance as you age; generally, a shift towards additional conservative investments is prudent as you in close proximity to retirement.

Tax factors Participate in a basic role in maximizing your retirement discounts. Benefit from tax-deferred accounts like 401(k)s and IRAs, which allow your investments to improve with no drag of once-a-year taxes, and think about Roth options for tax-cost-free withdrawals in retirement.

Bear in mind, nevertheless, that particular principles govern when and how one can accessibility these funds with out penalties.

Yet another considerable component is preparing for the unexpected. Insurance coverage products, including annuities and life insurance plan, can offer added stability, making certain that you won't outlive your price savings or leave your dependents monetarily strained.

Last of all, It is important to review and alter your retirement approach periodically, Specifically immediately after major life gatherings or sizeable market modifications.

This adaptive tactic not simply safeguards your price savings but will also boosts your economical resilience, making sure you happen to be properly-geared up for a cushty retirement.

Productive monetary preparing hinges on your ability to evaluate your current monetary standing, established real looking plans, and diligently manage your spending budget and personal debt. Discovering assorted financial commitment possibilities and planning for retirement are necessary measures toward securing your money upcoming. Often revisiting and adjusting your economical system guarantees it continues to be aligned with all your evolving money wants and goals. Embrace these strategies to navigate your economic journey with confidence and precision.

Edward Furlong Then & Now!

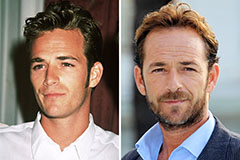

Edward Furlong Then & Now! Luke Perry Then & Now!

Luke Perry Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!